Calculating accrued holiday pay for departing employees by hand can be cumbersome and easy to get wrong. Use our ACAS compliant holiday pay calculator to make life easier, reduce errors and make sure you pay leavers the correctly.

Download a free Excel of this calculator

To see and check how we calculated these values, download this calculator as a spreadsheet. If you find any mistakes or have suggestions how we can improve it, please reach out to info@zelt.app.

Download ACAS holiday pay calculation excel file

What is holiday pay?

Employees are entitled to one week’s pay for each week of statutory leave, aka holiday pay, they take. A week’s pay is calculated according to the working pattern and how they’re paid for the hours worked.

Full-time employees are entitled to 28 days of holiday pay per year, which means they are able to take 28 days off per year and receive pay for it, too.

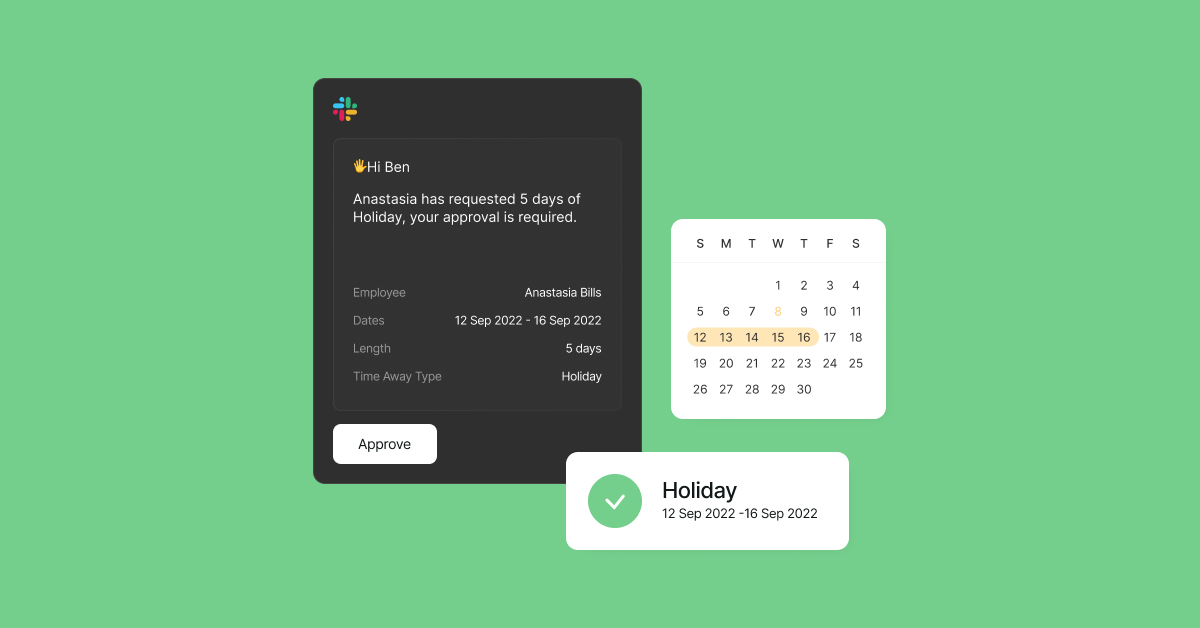

Automate holiday pay in your payroll software

Once you become an employer in the UK, you need to make sure you’re able to calculate holiday pay correctly. Modern payroll software automatically calculates holiday pay for departing employees in their final pay check. This saves you time having to type in information about the employee manually into a calculator and eliminates the mistake of potential typos of misconfigurations, e.g. picking the incorrect amount of days worked.

Visit our guide how to choose the right payroll software for your business to reduce the risk of miscalculating statutory entitlement and visit Zelt, nominated as one of the best payroll software in the UK.

How to calculate holidays?

Step 1: Calculate pro-rated holiday allowance for the year

The first step in calculating whether an employee is due to be paid in lieu for any unused holiday is to calculate their updated holiday allowance. Regulation states that this updated leave is calculated based on calendar days in employment, not days spent working. The calculation for all employee types is below;

Leave entitlement for full year x Proportion of leave year in employment

Note that an employee is entitled to 5.6 weeks of annual leave per year as a statutory minimum. Your company policy can offer more days in addition, however it cannot be below that amount.

Under working time regulations 1998 if an employee’s leave year is not specified within their contract, their holiday leave year starts from the date their employment began. It then runs from the anniversary of this date thereafter

Step 2: Add any holiday carry over from last year

Employees can carry over 1.6 weeks* worth of statutory leave for one leave year through an agreement between the employer and the employee. Therefore, when calculating any updated holiday allowance or pay in lieu of holidays, employers need to add on top whether the employee has any holiday days carried over from the previous leave year

Note if your employee is not full time the 1.6 weeks above will decrease proportionally with that employees FTE percentage. For example if the employee works 4 days a week they are to 80% (4/5) of the total allowance of 1.6 weeks, i.e. 1.28 weeks.

If you’d like to learn more about employees’ statutory leave rights such as annual leave and sick pay check out our employer’s guide to the types of leave in the UK.

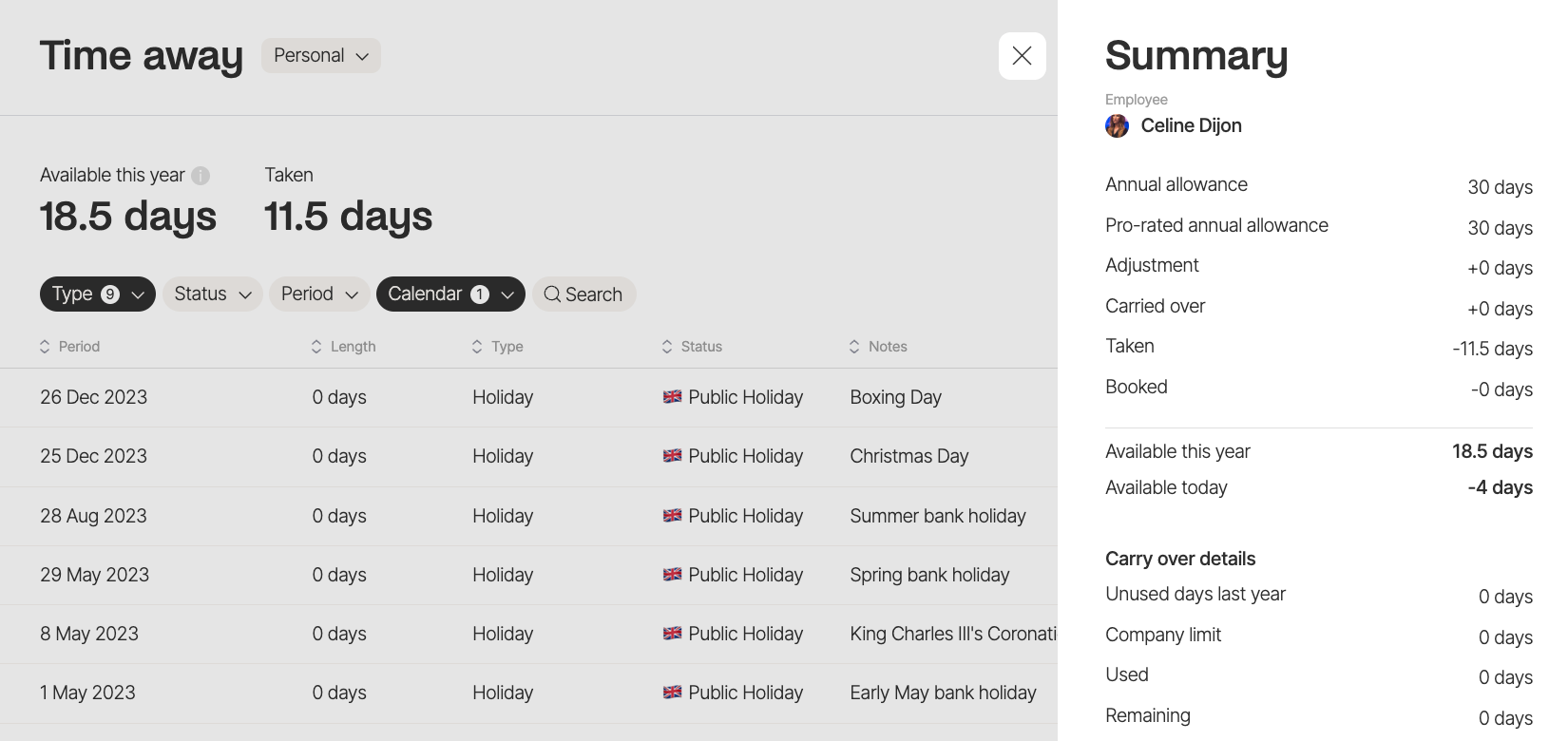

Step 3: Consider bank holidays for the remaining balance

Statutory leave entitlement in the U.K (shown below) is inclusive of bank holiday allowance. However, company holiday policies may choose to be exclusive of bank holidays as long as they meet the statutory minimum. In this case employees may automatically receive bank holidays off and their holiday balance is considers non-bank holiday holidays only.

As a result, in our calculator we will ask whether or not the holiday allowance is inclusive of bank holidays or not. If you choose no, we will add the bank holiday allowance on top of the specified allowance

Step 4: Deduct any holidays taken this year

The next step is to add how many holidays your employee has taken within the current leave year. Don’t worry about bank holidays taken, our calculator will add these on top based on your jurisdiction

Step 5: Convert updated holiday allowance into a payment in lieu

Based on the gross salary and the salary basis (over what time period does the salary cover) the calculator will convert this into a day rate and then multiply by the updated holiday allowance. This will produce an amount owed either by you or your employee

How to calculate annual holiday entitlement

Nearly every type of worker in the U.K is entitled to a minimum of 5.6 weeks of paid leave each year, known as statutory leave. Below is a reminder of how to calculate the amount of leave your employee is entitled to. This can differ depending on their working pattern

Work contracts based on fixed days per week

Employees who work regular working hours and fixed days each week should have their holiday entitlement calculated in days

The statutory holiday allowance for an employee who works a full leave year is the lower of either:

a) 28 days; or

b) 5.6 x days worked per week

Work contracts with compressed fours or hours per week

When employees work a fixed number of hours each week but not necessarily the same number each day , the below calculation is best practice. In this scenario, it’s best to calculate holiday allowance in hours

Statutory allowance = average working day in hours x annual allowance in days

Allowance in days is then the lower of:

a) 28 days; or

b) 5.6 x days worked per week

* Average working day is calculated as:

average working day = hours worked per week ÷ days worked per week

Annual leave entitlement of shift workers

For employees that work shifts the best practice calculation for statutory allowance is show below. Note, this should only be used when the shift patterns are the same length. If they’re not the same length it’s recommended that the days worked per week or hours worked per week calculation should be used

Allowance in days is the lower of:

a) 5.6 weeks x average shifts per week; or

b) 28 days’ worth of shifts

* Average shifts per week = (Shifts per shift pattern ÷ Calendar days per shift pattern) x 7

How to calculate holiday allowance for an employee starting part-way in a leave year

Work contracts based on fixed days per week

Months started equates to how many months the employee is working during the current holiday cycle. For example, if your holiday cycle runs 1st Jan – 31st Dec and an employee joins on 1st July they will be entitled to 6 months worth of holiday allowance

Leave entitlement for a full leave year x (months started ÷ 12)

* rounded up to the next half or whole day (whichever is closer)

Work contracts with compressed hours or hours per week

Leave entitlement for full year x (months started ÷ 12) x average working day in hours

* Round up initially to the next half or whole day (whichever is closer)

* Average working day is calculated as:

average working day = hours worked per week ÷ days worked per week

Shift Workers

Leave entitlement for full year x (months started ÷ 12)

* rounded up to the next half or whole day’s worth of shifts (whichever is closer)

FAQs

How do you calculate holiday pay?

Holiday pay is calculated using your annual statutory leave entitlement of 5.6 weeks per year and pro rating to the amount of days you actually worked, based on your employment period in the holiday year and your working patter. If you were employed for the full year and work 5 days per week, you are entitled to 28 days. But if you worked only 2.5 days per week, or full-time for 6 months. for you employer, you receive 14 days.

How much is holiday pay?

Holiday pay is the amount of days you are entitled to annual leave multiplied by the value of a days work, based on your annual salary and 260 working days per year.

How does holiday pay work?

Holiday pay means you can take time off from work while still receiving your full salary, subject to your statutory leave allowance or your employer annual holiday allowance, whichever is higher.

How to calculate bank holiday for part time workers?

This calculator also works for part time workers. Simply enter the number of days worked on a weekly basis and the annual allowance is pro rated accordingly. T

Find this holiday pay calculator useful?

Use the other free calculators to make your life easier